Ann Hebert, vice president and general manager at Nike recently left her position after the reports of her teenage son reselling shoes online.

This came after her son, Joe Hebert, told Bloomberg Businessweek about his resale business and his success in profits. On February 25th, Bloomberg published an article about sneakerheads and the behind-the-scenes lifestyle for sellers, including one notable shop: West Coast Streetwear.

Ann Hebert left the position due to the suspicions that she had a major part in this operation that brought in thousands of dollars.

View this post on Instagram

The suspicions began after a simple phone call between Joe Hebert and Bloomberg’s Joshua Hunt when Hunt noticed that the call wasn’t from Joe’s phone, but another number.

After some research, Hunt found that the phone number belonged to Ann Hebert who recently stepped up as the vice president for the North American region for Nike.

At first it seems just like a cool coincidence that both Joe took on a similar path in careers having to do with shoes and streetwear like his mother did. Then, Joe showed a bank statement to show just how much money he has amassed in this business when a key feature set off an alarm- Ann’s name on the statement.

ADVERTISEMENT

This, paired with extremely rare shoes that are difficult to get hands on, lead to questions all around.

While Joe Hebert did clarify that what his mother does at Nike doesn’t allow him to receive discounts of any sorts for what he does, suspicions have stuck around.

How it’s Done

There’s many approaches to how someone could run a successful business reselling shoes like Joe Hebert has. One of the biggest ways he has had huge success is by using bots.

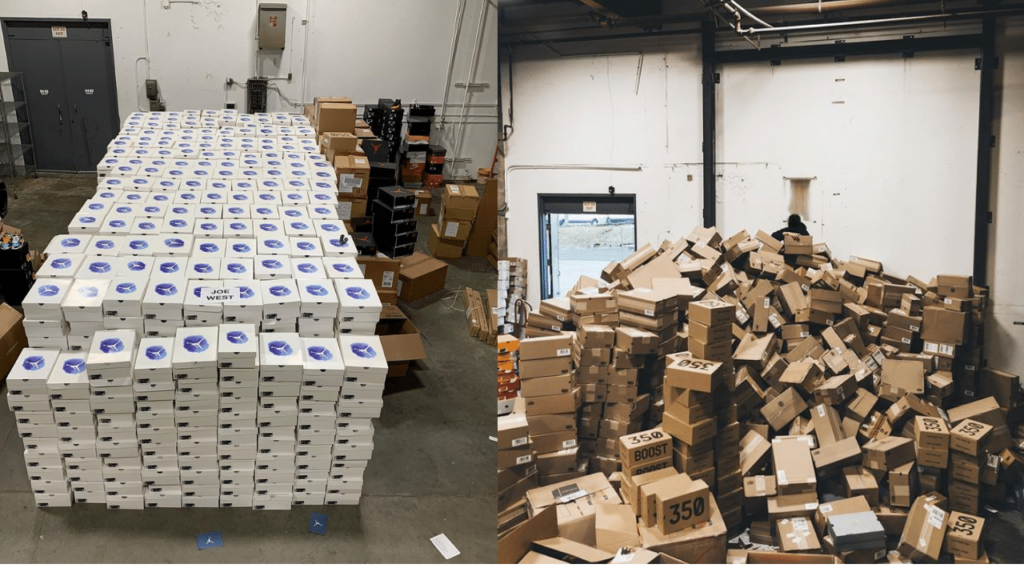

Bots are programs on a computer that are designed to do repetitive tasks and can help facilitate traffic. Hebert used these bots to help tackle the shoe releases and launches on major websites to have the best possible outcome. They can amass hundreds of shoes in moments thanks to these bots which is why it can be difficult for an average person to purchase shoes during these online releases.

In the article with Bloomberg, Joe Hebert notes how he goes about profit margins and approaching buying the mass orders of shoes.

“By 6 a.m. the shoes were sold out, and Hebert’s bots had rung up $132,000 on his American Express. His company, West Coast Streetwear, resold the shoes in almost as little time as it had taken to buy them, clearing $20,000 in profit,” as stated in Bloomberg Business.

ADVERTISEMENT

Hebert also has explained how the shoe obsession has affected them- notably during the pandemic.

“I remember the night the stimulus checks hit. My sales tripled. In May we did $600,000,” he said.

Behind the Scenes

Hebert began his reselling business in highschool after finding out that some of his own clothes under brand names like Supreme were selling for more than triple what he paid for them.

In 2017, Hebert began selling his shoes on StockX.

During this time, many shoe brands were transforming their market from in-store to online by switching from stores like Footlocker to websites. In the 2019 fiscal year alone, digital sales rose by more than a third.

Thanks to this online market making shoes much more accessible, sought-out shoes became more difficult to grasp because of mass resellers like West Coast Streetwear and more.

A major part of this process that’s time consuming is what customers want- verification that the items they bought are in fact the real thing. For many sellers on StockX, they send their products to a processing center to be authenticated and checked for quality.

Embed from Getty Images

One of Hebert’s biggest and most exciting sales was just after dropping out of the University of Oregon.

During this time, he came into contact with someone who said they found one of the most exclusive shoes around in a storage unit: Nike Mags. These shoes were the iconic look in Back to the Future II, with self-lacing shoes that everyone was in awe over. Hebert was extremely lucky to not only come across one pair, but four.

View this post on Instagram

His turn of profit from these shoes was about $20,000. He bought the four pair from the man and then flipped it for $42,000.

Other than major shoes like the Nike Mags, Hebert has also taken a dive into what is known as “bricks”. These are shoes that can sit on shelves for months or years due to not being as popular as other major shoe releases, and simply take up space in stores. However, there’s always a profit from them.

The biggest aspect that brings money is that the shoes are typically discounted from the original shoe retailer and someone is always seeking them. Thanks to this, profit can be turned for shoes that aren’t as popular per se.

Another tactic that has helped Hebert become successful is by taking on major metropolitan areas.

By doing this, he’s able to get his hands on more shoes in a short amount of time and have bigger profits. It’s also become an issue for outlet stores as they have had countless empty shelves due to these resellers, making the shoes much more exclusive.

Exclusive shoes and rumors amuck lead for an interesting sales year